Buying insurance leads from insurance lead companies is a gamble that often doesn’t pay out. Due to this risk, insurance agents should focus on more effective marketing strategies first.

Use marketing automation

Have you tried using marketing automation to get more value out of your existing network? Those contacts can be a source of referrals, repeat business and reviews.

HubSpot found that 80% of marketers using automation software generate more leads. There are a few reasons why marketing automation is so impactful. Here are three:

- Marketing automation helps build relationships. Businesses who nurture leads make 50% more sales and spend 33% less than non-nurtured prospects.

- Marketing automation increases lead numbers through content marketing. Content marketing gets three times more leads than paid advertising.

- Marketing automation captures prospect data for you. Marketing automation platforms like OutboundEngine provide an optimized website where marketing traffic is sent. It’s a vital part of capturing interested prospects and re-engaging with past clients.

Try social media advertising

Organic social media is great for staying top of mind with your followers, but paid social media advertising lets you reach beyond that ceiling. Paid ads help increase brand recognition by getting your business and brand in front of more eyes. They also let you hyper-focus on prospects with potentially higher ROI rates.

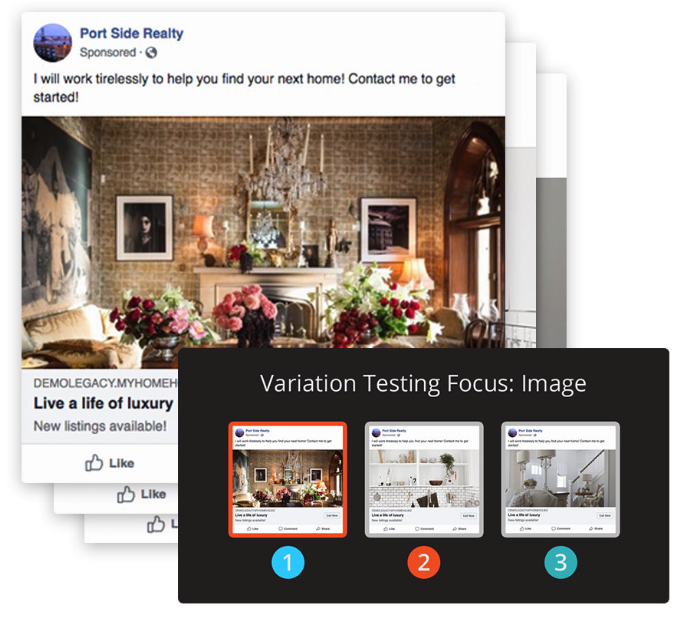

OutboundEngine offers customers the ability to run social ads that speak to their target audience. Combining Facebook and Instagram ads with an optimized website or landing page means users can capture and convert interested leads more easily.

Here’s an example of the social ad testing OutboundEngine includes:

These marketing methods are tried and true ways to grow your brand awareness. They aren’t quick fixes, but rather long-term strategies to help your business succeed over time. But if you’re still considering buying leads, consider the possible pitfalls.

Why buying leads doesn’t work

-

- Lead Quality

Not all leads are created equally. You might get outdated or flat out incorrect information. - Exclusivity

Most companies who sell leads share the same lists with all of their buyers. This means the prospects you contact have likely already been pitched or even closed. - Reputation

Ask around for the overall reputation of the lead company. Lead seller review sites can be unreliable. Find a few first person referrals or success stories before you buy. - Customer Service

Is there a phone number to call if you need assistance? How about a chat function? Some companies don’t even have an email address when customers have questions or want a refund. - Pricing

This may seem obvious, but buying leads can get extremely expensive, fast. If you’re okay with paying hundreds—or thousands—of dollars in one fell swoop even if you may never see a return on that investment, then maybe buying insurance leads will work for you. However, there are plenty of more cost-effective ways to find a new audience for your insurance business.

- Lead Quality

In short, instead of buying insurance leads, take more reliable and effective steps. OutboundEngine is a simple software that keeps you top of mind with existing clients while also engaging new ones. We help insurance professionals market their services and surface existing opportunities in their network Schedule a free, guided demo today to see how.

![Better Email Etiquette Equals Better Marketing Results [16 Rules]](https://www.outboundengine.com/wp-content/uploads/shutterstock_411184843-1-400x250.jpg)